题目内容

根据文章的内容选择最佳答案。

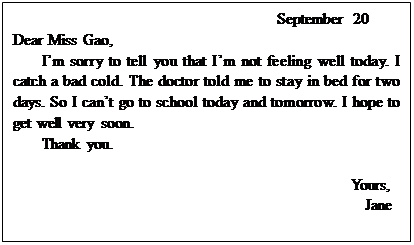

【小题1】.The note(便条) for leave was from _______ to .

A. Jane; the doctor B. Jane; Miss Gao C. the doctor; Miss Gao

【小题2】The note was written(被写) __________.

A. at school B. in Chinese C. on September 20

【小题3】Jane was not feeling well that day because __________.

A. she had a cold B. it was too cold C. she couldn’t go to school

【小题4】The doctor told Jane __________.

A. to stay at school

B. to stay in bed for two days

C. not to go to school later

【小题5】 Jane hoped to go to school on September __________.

A. 20 B. 21 C. 22

【小题1】B

【小题2】C

【小题3】A

【小题4】B

【小题5】C

解析试题分析:

【小题1】细节理解题,根据便条的称呼和署名可知,这则便条是Jane写给Miss Gao的,故选B。

【小题2】细节理解题,根据便条的内容理解可知,这则便条是在9月20号写的,它是用英语书写的,不是用汉语,有文中的语句I can’t go to school。可知不是在学校里写的,故选C。

【小题3】细节理解题,根据文中语句“I’m sorry to tell you that I’m not feeling well today. I catch a bad cold.”理解可知。Jane因感冒而感觉不好受,故选A。

【小题4】细节理解题,根据文中语句“The doctor told me to stay in bed for two days.”理解可知。医生要求Jane在家呆两天,故选B。

【小题5】细节理解题,根据文中语句“So I can’t go to school today and tomorrow. I hope to get well very soon.”理解可知。今天是20号,两天之后就是22号,故选C。

考点:此题是一个请假便条,重点考查对其格式的正确把握,及对便条内容的理解。

点评:这是一则请假条,主要说明了自己为何请假以及请假的天数。对这类应用文的考查不仅仅是考查其具体内容,有时还有一些格式方面的内容,例如61题如果不知请假条的格式的话,有些同学就很难作对,因此对这类题目要多加训练,索取信息要广泛。

课堂全解字词句段篇章系列答案

课堂全解字词句段篇章系列答案 步步高口算题卡系列答案

步步高口算题卡系列答案Traditionally, the President is the highest-pad public employee. A salary of $ 400,000, along with other benefits, is paid to the President annually. But President Obama’s income for 2008 was far more than that, according to the White House.

The White House recently published the tax returns (纳税申报单)of Obama and Vice –president Joe Biden. Tax returns are reports of tax that a person has to pay. They often include income information used to calculate the tax. In the US, people whose incomes are over a certain amount have to file tax returns(纳税申报)every year. The tax returns of government officials are open to the public. This transparency helps to prevent corruption(腐败)。

From Obama’s tax returns , we can see that the President and first lady President’s two books Dreams From My Father and The Audacity of Hope(《无畏的梦想》). The two books, published in 1995 and 2006,are very popular and have been on the bestseller(畅销书)list for a long time.

The Obama’s income is down from 2007,when they made $4.2 million. However, that is still far more than former US President George Bush earned, who reported a total of $719,274 for his final year. The Obamas’ income also greatly exceeded(超出)that of Biden, who reported a family income of $2269,256.That’s about a tenth of what the Obamas earned. As Vice-president, Biden earns a salary of $220,000.US families earn an average income of about $50,000.

The Obama’s tax returns also show that together, the President and his wife paid about $933,000 in taxes. They gave $172,050 —nearly 6.5 percent of their earnings —to different charity groups. In the US, if a person gives his money to churches and non-profit(非盈利)organizations, the law reduces his or her taxes. This is one reason why rich people in the US like to give money to charity.

【小题1】_______had the highest income in 2008.

| A.Obama | B.Biden | C.Bush | D.George |

| A.$400,000 | B.$2,660,000 | C.$4,200,000 | D.$719,274 |

| A.Everybody |

| B.Wealthy people |

| C.Government officials |

| D.People whose incomes are over a certain amount. |

| A.10 | B.6.5 | C.9.7 | D.4.3 |

| A.Because it can help to prevent corruption |

| B.Because it can make government officials well-known to the public. |

| C.Because it can help government officials to get more money. |

| D.Because the government wants them to pay more taxes to the public. |

| A.he will be praised by the people |

| B.he will pay fewer taxes |

| C.he will be free of taxes |

| D.he will get some extra money from the government. |

Choose the best answer (根据文章内容,选择最恰当的答案)

Traditionally, the President is the highest-pad public employee. A salary of $ 400,000, along with other benefits, is paid to the President annually. But President Obama’s income for 2008 was far more than that, according to the White House.

The White House recently published the tax returns (纳税申报单)of Obama and Vice –president Joe Biden. Tax returns are reports of tax that a person has to pay. They often include income information used to calculate the tax. In the US, people whose incomes are over a certain amount have to file tax returns(纳税申报)every year. The tax returns of government officials are open to the public. This transparency helps to prevent corruption(腐败)。

From Obama’s tax returns , we can see that the President and first lady President’s two books Dreams From My Father and The Audacity of Hope(《无畏的梦想》). The two books, published in 1995 and 2006,are very popular and have been on the bestseller(畅销书)list for a long time.

The Obama’s income is down from 2007,when they made $4.2 million. However, that is still far more than former US President George Bush earned, who reported a total of $719,274 for his final year. The Obamas’ income also greatly exceeded(超出)that of Biden, who reported a family income of $2269,256.That’s about a tenth of what the Obamas earned. As Vice-president, Biden earns a salary of $220,000.US families earn an average income of about $50,000.

The Obama’s tax returns also show that together, the President and his wife paid about $933,000 in taxes. They gave $172,050 —nearly 6.5 percent of their earnings —to different charity groups. In the US, if a person gives his money to churches and non-profit(非盈利)organizations, the law reduces his or her taxes. This is one reason why rich people in the US like to give money to charity.

【小题1】_______had the highest income in 2008.

| A.Obama | B.Biden | C.Bush | D.George |

| A.$400,000 | B.$2,660,000 | C.$4,200,000 | D.$719,274 |

| A.Everybody |

| B.Wealthy people |

| C.Government officials |

| D.People whose incomes are over a certain amount. |

| A.10 | B.6.5 | C.9.7 | D.4.3 |

| A.Because it can help to prevent corruption |

| B.Because it can make government officials well-known to the public. |

| C.Because it can help government officials to get more money. |

| D.Because the government wants them to pay more taxes to the public. |

| A.he will be praised by the people |

| B.he will pay fewer taxes |

| C.he will be free of taxes |

| D.he will get some extra money from the government. |

| 根据文章内容,选择最恰当的答案。 Traditionally, the President is the highest-pad public employee. A salary of $ 400,000, along with other benefits, is paid to the President annually. But President Obama's income for 2008 was far more than that, according to the White House. The White House recently published the tax returns (纳税申报单) of Obama an d Vice -president Joe Biden. Tax returns are reports of tax that a person has to pay. They often include income information used to calculate the tax. In the US, people whose incomes are over a certain amount have to file tax returns(纳税申报)every year. The tax returns of government officials are open to the public. This transparency helps to prevent corruption (腐败). From Obama's tax returns , we can see that the President and first lady President's two books Dreams From My Father and The Audacity of Hope (无畏的梦想). The two books, published in 1995 and 2006,are very popular and have been on the bestseller (畅销书) list for a long time. The Obama's income is down from 2007,when they made $4.2 million. However, that is still far more than former US President George Bush earned, who reported a total of $719,274 for his final year. The Obamas' income also greatly exceeded(超出)that of Biden, who reported a family income of $2269,256. That's about a tenth of what the Obamas earned. As Vice-president, Biden earns a salary of $220,000. US families earn an average income of about $50,000. The Obama's tax returns also show that together, the President and his wife paid about $933,000 in taxes. They gave $172,050 -nearly 6.5 percent of their earnings -to different charity groups. In the US, if a person gives his money to churches and non-profit (非盈利) organizations, the law reduces his or her taxes. This is one reason why rich people in the US like to give money to charity. | ||

|