��Ŀ����

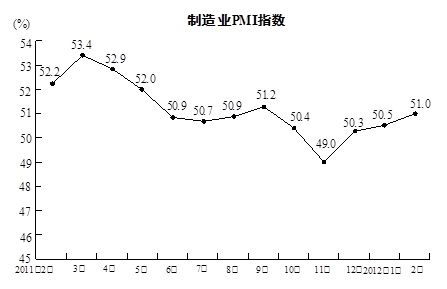

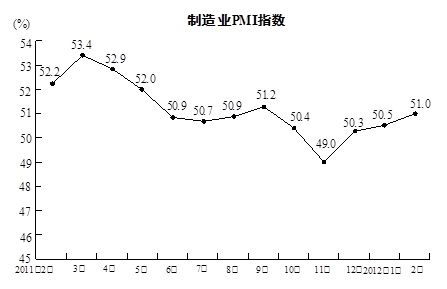

PMIָ��Ӣ��ȫ��Purchase Management Index�����ķ���Ϊ�ɹ�����ָ����PMI��һ���¶ȷ����ġ��ۺ��Եľ��ü��ָ����ϵ����Ϊ����ҵPMI������ҵPMI��PMI��ͨ���Բɹ��������¶ȵ�����ܳ�����ָ������ӳ�˾��õı仯���ƣ���ͼ��Դ��2012��3��2�յġ����п챨������ӳ��2011��2����2012��2���ڼ��ҹ�����ҵPMIָ���仯����������������Ϣ�����ͼ����������⣺

��1�������ϸ���PMIָ���У���λ���� %�������� %��

��2�����й���ͼ��Ľ���У���ȷ���� ������д��ţ���

���ҹ�����ҵPMIָ�������������»�����������������¸ߣ�

�ڴ�ͼ��ɿ������ҹ����óʡ����������������ƣ�

����2011��2����2012��2���ҹ�����ҵPMIָ����ǰһ���½��Ķ��������ģ�

��3�����������ҹ�����ҵPMIָ������2012��1����2012��2�µ������ٶ�����������Ƶ����·ݾͿɸϳ�2011������ֵ53.4%��

��1�������ϸ���PMIָ���У���λ���� %�������� %��

��2�����й���ͼ��Ľ���У���ȷ���� ������д��ţ���

���ҹ�����ҵPMIָ�������������»�����������������¸ߣ�

�ڴ�ͼ��ɿ������ҹ����óʡ����������������ƣ�

����2011��2����2012��2���ҹ�����ҵPMIָ����ǰһ���½��Ķ��������ģ�

��3�����������ҹ�����ҵPMIָ������2012��1����2012��2�µ������ٶ�����������Ƶ����·ݾͿɸϳ�2011������ֵ53.4%��

�⣺��1��50.9��4.4

��2���٣���

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%����

(51.0%-50.5%)x��53.4%-51.0%�����x��4.8

�𣺵�7�·ݾͿɸϳ�2011������ֵ53.4%��

��2���٣���

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%����

(51.0%-50.5%)x��53.4%-51.0%�����x��4.8

�𣺵�7�·ݾͿɸϳ�2011������ֵ53.4%��

��1��������λ��������Ķ�����⼴�ɣ�

��2����������ͳ��ͼ�ҵ����õı仯���ɼ��ɣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%�����ݸϳ�2011������ֵ53.4%�г��й�x��һԪһ�β���ʽ��⼴�ɣ�

��2����������ͳ��ͼ�ҵ����õı仯���ɼ��ɣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%�����ݸϳ�2011������ֵ53.4%�г��й�x��һԪһ�β���ʽ��⼴�ɣ�

��ϰ��ϵ�д�

�Ķ��쳵ϵ�д�

�Ķ��쳵ϵ�д�

�����Ŀ