��Ŀ����

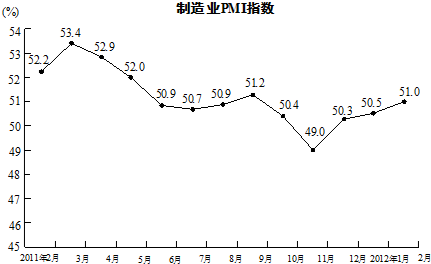

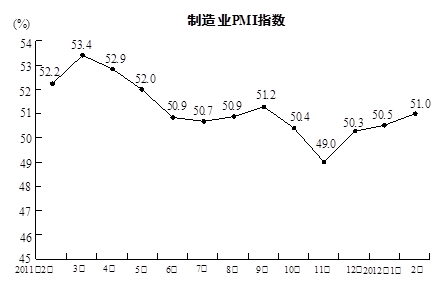

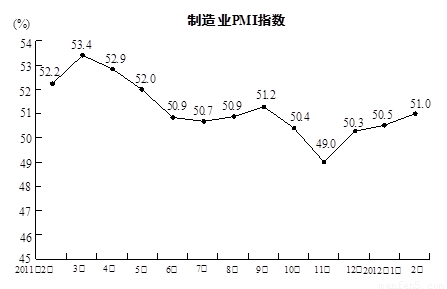

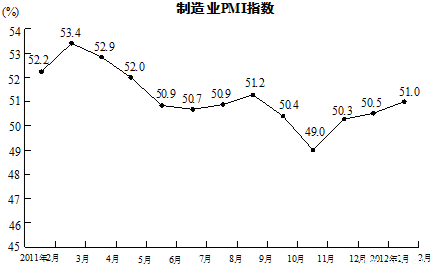

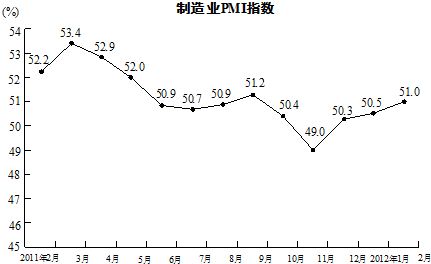

PMIָ��Ӣ��ȫ��Purchase Management Index�����ķ���Ϊ�ɹ�����ָ����PMI��һ���¶ȷ����ġ��ۺ��Եľ��ü��ָ����ϵ����Ϊ����ҵPMI������ҵPMI��PMI��ͨ���Բɹ��������¶ȵ�����ܳ�����ָ������ӳ�˾��õı仯���ƣ���ͼ��Դ��2012��3��2�յġ����п챨������ӳ��2011��2����2012��2���ڼ��ҹ�����ҵPMIָ���仯����������������Ϣ�����ͼ����������⣺

��1�������ϸ���PMIָ���У���λ����________%��������________%��

��2�����й���ͼ��Ľ���У���ȷ����________������д��ţ���

���ҹ�����ҵPMIָ�������������»�����������������¸ߣ�

�ڴ�ͼ��ɿ������ҹ����óʡ����������������ƣ�

����2011��2����2012��2���ҹ�����ҵPMIָ����ǰһ���½��Ķ��������ģ�

��3�����������ҹ�����ҵPMIָ������2012��1����2012��2�µ������ٶ�����������Ƶ����·ݾͿɸϳ�2011������ֵ53.4%��

�⣺��1����13�����ݣ������м�λ�õ���50.9%��

����λ��Ϊ50.9%��

����Ϊ53.4%-49.0%=4.4%��

��2���۲�����ͳ��ͼ����2011��11�µ�2012��2������3�����������Ҵ��´�2011��10�¿�ʼ��������µ��¸ߣ��ʢ���ȷ��

�۲�ͳ��ͼ�����ҹ����þ�����С���ĵ��֮��ʼ�����������ʢ���ȷ��

�۲�ͳ��ͼ�����м����³����������ʢ۴���

�ʴ�Ϊ�٢ڣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%����

��51.0%-50.5%��x��53.4%-51.0%��

���x��4.8

�𣺵�7�·ݾͿɸϳ�2011������ֵ53.4%��

��������1��������λ��������Ķ�����⼴�ɣ�

��2����������ͳ��ͼ�ҵ����õı仯���ɼ��ɣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%�����ݸϳ�2011������ֵ53.4%�г��й�x��һԪһ�β���ʽ��⼴�ɣ�

���������⿼��������ͳ��ͼ������Ĺؼ�����ϸ�Ĺ۲�����ͳ��ͼ����������ͳ��ͼ����������һ��������й���Ϣ��

����λ��Ϊ50.9%��

����Ϊ53.4%-49.0%=4.4%��

��2���۲�����ͳ��ͼ����2011��11�µ�2012��2������3�����������Ҵ��´�2011��10�¿�ʼ��������µ��¸ߣ��ʢ���ȷ��

�۲�ͳ��ͼ�����ҹ����þ�����С���ĵ��֮��ʼ�����������ʢ���ȷ��

�۲�ͳ��ͼ�����м����³����������ʢ۴���

�ʴ�Ϊ�٢ڣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%����

��51.0%-50.5%��x��53.4%-51.0%��

���x��4.8

�𣺵�7�·ݾͿɸϳ�2011������ֵ53.4%��

��������1��������λ��������Ķ�����⼴�ɣ�

��2����������ͳ��ͼ�ҵ����õı仯���ɼ��ɣ�

��3�����ٹ�x���¿ɸϳ�2011������ֵ53.4%�����ݸϳ�2011������ֵ53.4%�г��й�x��һԪһ�β���ʽ��⼴�ɣ�

���������⿼��������ͳ��ͼ������Ĺؼ�����ϸ�Ĺ۲�����ͳ��ͼ����������ͳ��ͼ����������һ��������й���Ϣ��

��ϰ��ϵ�д�

�����Ŀ